When the United States adds a 25% tariff on Indian goods, doubling the total to 50%, the ripple effect reaches far beyond trade—right into India’s stock market. Let’s break it down with a clear, everyday‑example approach.

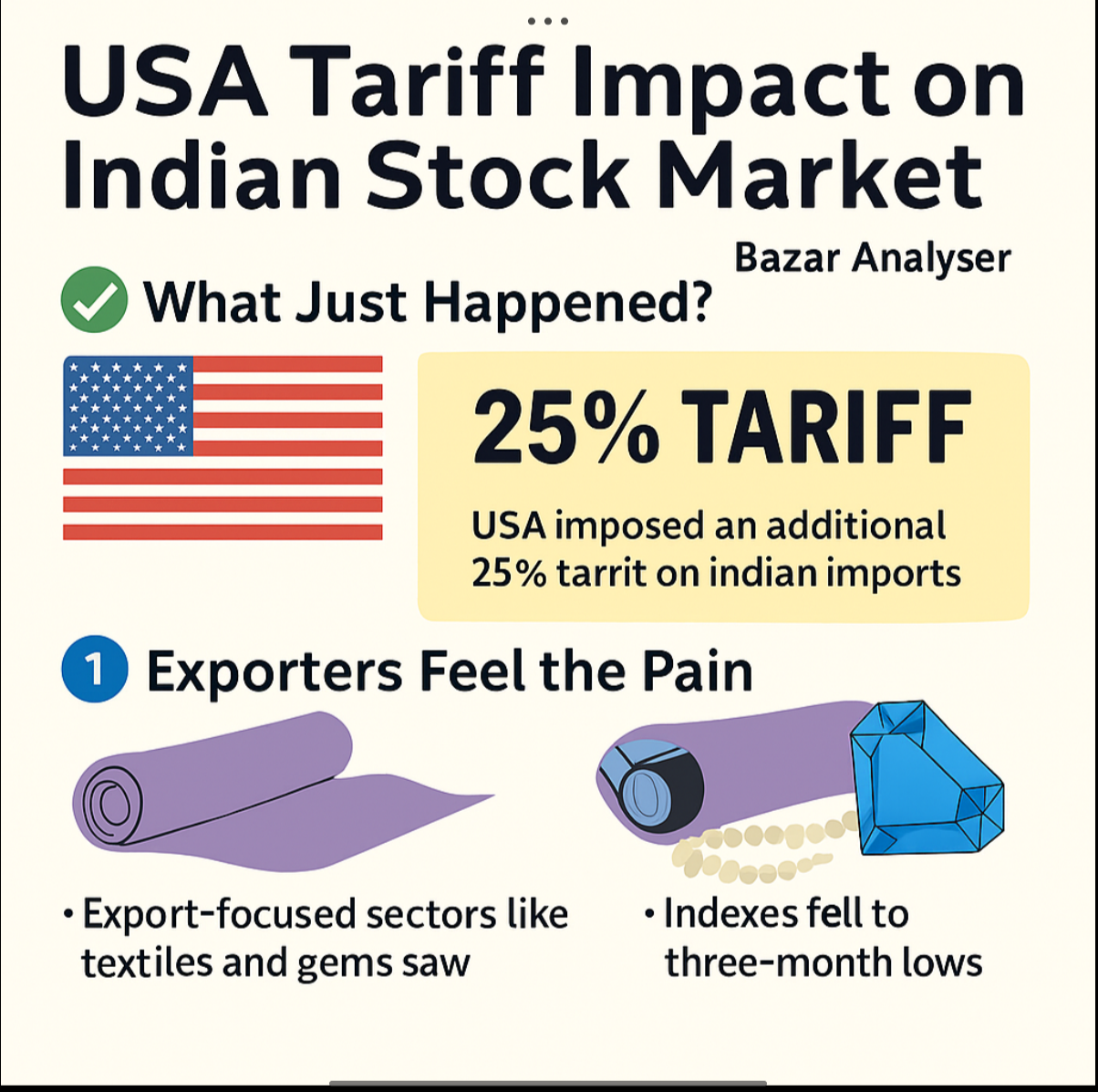

What Just Happened?

On August 6, 2025, the U.S. government imposed an additional 25% “secondary tariff” on Indian imports, targeting India’s ongoing purchase of Russian oil. This brings the total tariff to 50%, set to take effect around August 27.

Why It Matters for India’s Markets

1. Exporters Feel the Pain

U.S. trade‑exposed sectors—like textiles, gems, and jewellery—observe sharp price hikes. Companies such as Trident, Gokaldas Exports, and Arvind saw stock drops of 0.7% to 3%.

The spice industry also took a hit: tariffs on cumin and isabgol are expected to cut trade volumes by 15%.

2. Nifty & Sensex React Fast

Indian benchmarks slipped to three‑month lows—the Nifty 50 down to 24,475.55, and Sensex to 80,236.69.

In another session, the Sensex fell over 500 points, with Nifty testing the 24,400 level.

Yet, markets showed resilience—closing near 24,600 for Nifty as late‑day buying helped recover some losses.

3. Investor Sentiment & Foreign Flows

Heightened trade tension triggered foreign institutional investor (FII) outflows—around $900 million withdrawn in August alone.

Even though the tariff decision was expected, it still caused market uncertainty and volatility.

4. Economic and Strategic Context

India called the tariff move “unfortunate” and “unjustified”, defending its energy choices. Analysts expect the measure to affect up to **55% of India’s exports to the U.S.**

The tariff is labeled a “secondary tariff,” designed to pressure India’s ties with Russia—distinct from traditional sanctions.

Real‑Life Analogy

Imagine you’re a local chai seller selling cups to a big neighbouring town. Suddenly, the neighbor doubles the entry fee for your cups (from ₹10 to ₹20 each). Your customers drop, your tea sells less, and you worry about your profit. That’s exactly how a 50% tariff affects Indian exporters—fewer buyers, lower profit, and worried investors.

Final Thoughts – Bazar Analyser’s Tip

This 25% tariff hike (bringing total to 50%) isn’t just international news—it’s a trigger for global investors to pause, reconsider, and react.